Wage File Upload Instructions - Creating a .txt File with Excel

Arizona Unemployment Tax and Wage System

Employee and Wage File Upload Instructions Required Format

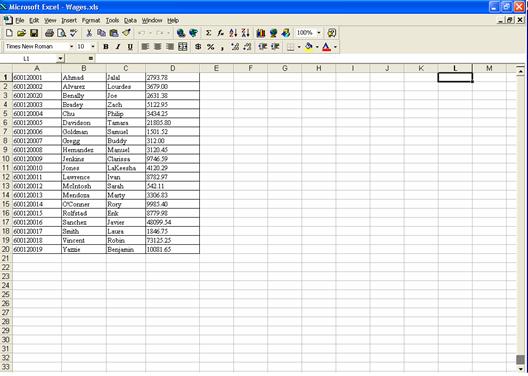

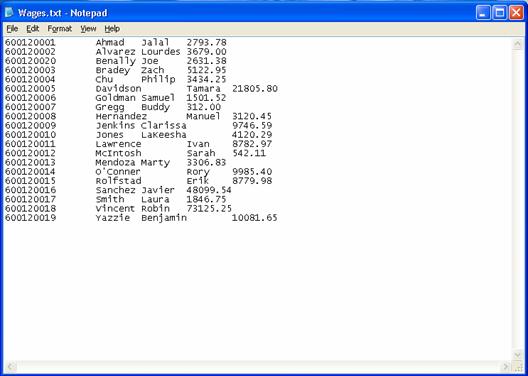

Step 1. Open or create the wages file using Excel and key data into the four required columns, SSN, Last Name, First Name and Total Wages. Excess Wages is optional. See Figure 1 below.

Tip: Do not put any spaces or special characters in the Social Security column; do not format the Total Wages or Excess Wages columns with dollar signs or commas; do enter a decimal point and cents; use text format. Do not allow blank lines between employees or after the last employee record.

Figure1.txt

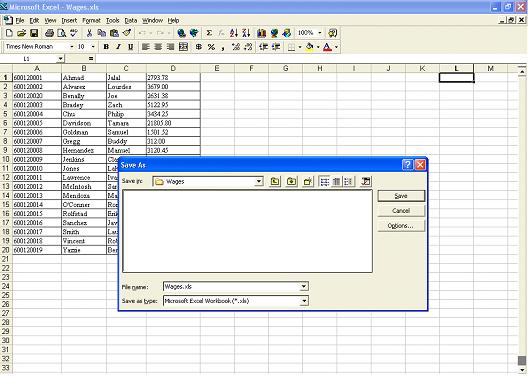

Step 2. Open the menu item File-Save As. See Figure 2 below.

Figure2.txt

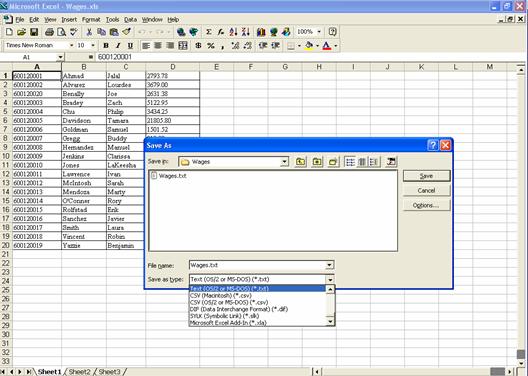

Step 3. Select Text from the “Save As Type” list box. You will notice that once this is selected Excel will automatically change your file extension in the “File Name” box from .xls to .txt. See Figure 3 below.

Figure3.txt

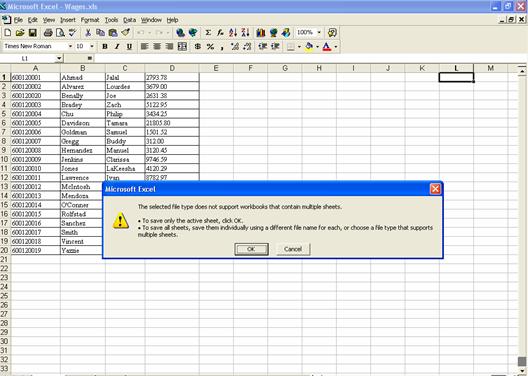

Step 4. After you click Save, Excel may prompt you with a message box stating, "The selected File type does not support workbooks that contain multiple sheets. To save only the active sheet, click OK."You only want to save the active sheet, so click OK to continue.

Figure4.txt

The Wages file should now be saved as a .txt file.

Step 5. Next, it is necessary to open the Wages.txt file you just created. See Figure 5 below.

Figure5.txt

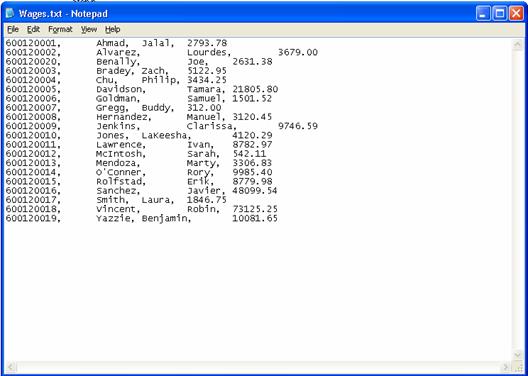

Step 6. Commas must be entered between each field EXCEPT after the last item on the line. Be sure there are no blank lines after the last record. See figure 6 below. This must be done for every line in the quarterly wages file.

Figure6.txt

Once you are finished, save and close the text file. Your file is now ready to be uploaded into the Arizona Unemployment Tax and Wage System.

Login to the Tax and Wage System

Related Topics: