Main menu

- About DES

- Services

- Basic Needs

- Adult Protective Services

- Food Assistance

- Nutrition Assistance

- How to Apply for Nutrition Assistance

- Frequently Asked Questions

- Change Report for Nutrition, Cash, and Medical Assistance Benefits

- Electronic Benefits Transfer (EBT) Card

- Health-e-Arizona Plus Application

- Publications for Nutrition, Cash, and Medical Assistance Benefits

- Work Requirements for Able-Bodied Adults Without Dependents

- Double Up Food Bucks

- Student Eligibility for SNAP

- How to Support Health in your Home

- Hunger Relief Programs

- Other Food Programs

- Information for DES Partners

- Other Resources

- Appeals

- Contact DES

- Customer Bill of Rights

- Limited English Proficiency

- Office of Program Evaluation

- USDA Programs Nondiscrimination Statements

- Nutrition Assistance

- Medical Assistance

- Refugee Resettlement

- Shelter and Housing

- Domestic Violence Support

- Sexual Violence Support

- Child and Family

- Disabilities

- Older Adults

- Employment

- Job Seekers

- Reentry Services

- Employer Resources

- Apprenticeship

- Unemployment - Individual

- Apply for UI Benefits

- File Your Weekly UI Claims

- ID.me Identity Verification

- Overpayments

- Reemployment Services and Eligibility Assessment (RESEA)

- Disaster Unemployment Assistance

- Pandemic Unemployment Assistance

- ARIZONA@WORK Employment Resources

- Income Tax Information

- Eligibility for Unemployment Benefits

- Work Search and Your Eligibility for Unemployment Benefits

- How Do I and Frequently Asked Questions

- Forms & Pamphlets

- Contact Arizona UI

- UI Benefit Fraud

- How To File An Appeal For UI Benefits

- UI Data Dashboard

- Working with a Disability

- Employment Service/Related Law Complaint

- Unemployment - Employer

- Applying for an Unemployment Insurance Tax Account Number

- Report Changes to Your Business

- Reporting Wages and Paying Unemployment Insurance Taxes

- Employment Taxes - Calculating Unemployment Taxes

- Unemployment Insurance Tax Forms

- Unemployment Insurance Tax Frequently Asked Questions

- Request UI Records

- Employer Handbook/ Unemployment Tax

- Employer Handbook/ Unemployment Benefit Claims

- AZ Unemployment Insurance Tax Survey

- Contact the Unemployment Tax Office

- Arizona Shared Work Program

- Senior Community Service Employment Program

- Veterans

- Workforce Innovation and Opportunity Act (WIOA)

- Arizona State Monitor Advocate

- Basic Needs

- How do I?

- Do Business with DES?

- Request a Vendor Meeting

- Frequently Asked Questions

- Learn about HIPAA?

- Request Assistance?

- Request DES Records?

- Submit Website Feedback?

- Work for DES?

- ADA Disability Rights/Reasonable Accommodations

- Volunteer?

- File a Discrimination Complaint

- Report Developmental Disabilities Fraud, Waste and Abuse

- Documents Center

- Media Center

- Office Locator

- Report Fraud

Receiving Unemployment Insurance Benefits

When can I expect to receive my first payment?

You must have earned sufficient wages in your base period to qualify for a claim in order to receive benefit payments. Your Wage Statement (UB-107) will show a weekly benefit amount and total award if you've earned enough wages to qualify. If there are other eligibility issues, they must be resolved before any payments are issued to you.

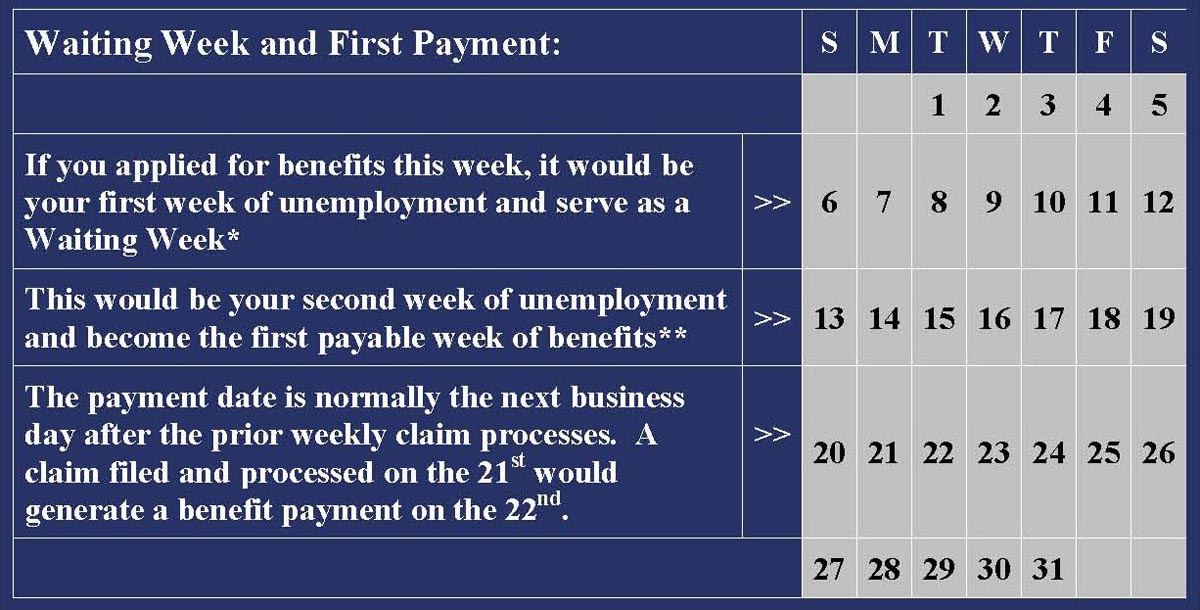

In the example shown below, the first week of unemployment on a newly established benefit year is a waiting week *. If there are no issues established on your claim, you can expect your first benefit payment** (normally after you've filed your second weekly claim) within approximately 10 business days.

As mentioned above, if there are eligibility issues that need to be resolved; for example, if you received severance or payment for unused vacation or sick leave, someone has to verify the amount, the dates, and other information before issuing a decision and clearing your claim for payment. View more information about eligibility issues.

In most cases where there is an issue, the first payment can usually be processed within 15 business days (if you are determined eligible for benefits). For the remainder, it can take longer.

All of this depends on whether you are determined eligible for benefits and file your weekly claims for each week you remain unemployed.

Note: If you skip or miss filing more than two consecutive benefit weeks, your claim becomes inactive. View information about filing weekly claims.

Will I receive a check in the mail or how will payments be made?

If you qualify for UI benefits, you will automatically be enrolled in the Electronic Payment Card (EPC) program. You should receive your EPC card by mail within a week after your initial application is processed; provided you are monetarily eligible (refer to your Wage Statement UB-107). Your EPC card will have a zero balance until your first benefit payment has processed. View information about our Electronic Payment Card.

How long will my benefits last?

You may have up to 26 weeks of UI benefit payments, depending on how much you earned in your base period. If you return to work or if you have deductible income for any week, you may collect more or less than 26 weeks. The total amount you can collect for the year is the maximum benefit amount shown on your Wage Statement (monetary determination).

Can I check the status of my payments online?

You can find all of the following information either online or by phone:

- View the latest benefit payment made to you;

- Obtain information about the last week you filed if you did not receive a payment; and

- Check the balance remaining on your current claim.

Benefit payment information may also be viewed for the most recently completed calendar year (for tax purposes). Visit our Income Tax Information page for more information.

Instructions for checking your claim status online: Access the Weekly Claims system and after choosing "English" or "Spanish", enter your Social Security Number and click the "View Payment Info" tab.

To check by phone: Call the Telephone Information and Payment System, and select Option 2 for the latest payment made to you, or information about the last week you filed if you did not receive a payment, and the balance remaining on your current claim. View more information about the telephone options available for other various UI claim inquiries.

If you checked your Unemployment Insurance benefit status (as outlined above) and it shows benefits were paid, but the balance on your Electronic Payment Card (EPC) is zero, please contact the Way2Go card® call center toll-free at 1-833-915-4041, TTY: 877-427-4172, or by Direct International at 1-214-210-2249.

I think I'm missing a payment, who do I contact?

If you have checked your claim Information online or by phone and find that a payment was issued and the amount is not showing up on your EPC/debit card or in your checking/savings account (if you've chosen to receive payments via direct deposit); you must contact the Way2Go card® call center toll-free at 1-833-915-4041, TTY: 877-427-4172, or by Direct International at 1-214-210-2249 (for EPC/debit card funds) or your personal bank/credit union (for funds that were made via direct deposit).

Benefits are no longer sent via paper checks as part of the Department's effort to reduce costs. However, a few individuals receive temporary paper checks by mail. If your paper check is missing, lost, or stolen, please complete the Unemployment Insurance Benefits Missing/Lost/Stolen Checks form immediately.

Arizona State Resources

Pursuant to Title VI of the Civil Rights Act of 1964, the Americans with Disabilities Act (ADA) and other nondiscrimination laws and authorities, ADES does not discriminate on the basis of race, color, national origin, sex, age, or disability. Persons that require a reasonable modification based on language or disability should submit a request as early as possible to ensure the State has an opportunity to address the modification. The process for requesting a reasonable modification can be found at Equal Opportunity and Reasonable Modification