Main menu

- About DES

- Services

- Basic Needs

- Adult Protective Services

- Food Assistance

- Nutrition Assistance

- How to Apply for Nutrition Assistance

- Frequently Asked Questions

- Change Report for Nutrition, Cash, and Medical Assistance Benefits

- Electronic Benefits Transfer (EBT) Card

- Health-e-Arizona Plus Application

- Publications for Nutrition, Cash, and Medical Assistance Benefits

- Work Requirements for Able-Bodied Adults Without Dependents

- Double Up Food Bucks

- Student Eligibility for SNAP

- How to Support Health in your Home

- Hunger Relief Programs

- Other Food Programs

- Information for DES Partners

- Other Resources

- Appeals

- Contact DES

- Customer Bill of Rights

- Limited English Proficiency

- Office of Program Evaluation

- USDA Programs Nondiscrimination Statements

- Nutrition Assistance

- Medical Assistance

- Refugee Resettlement

- Shelter and Housing

- Domestic Violence Support

- Sexual Violence Support

- Child and Family

- Disabilities

- Older Adults

- Employment

- Job Seekers

- Reentry Services

- Employer Resources

- Apprenticeship

- Unemployment - Individual

- Apply for UI Benefits

- File Your Weekly UI Claims

- ID.me Identity Verification

- Overpayments

- Reemployment Services and Eligibility Assessment (RESEA)

- Disaster Unemployment Assistance

- Pandemic Unemployment Assistance

- ARIZONA@WORK Employment Resources

- Income Tax Information

- Eligibility for Unemployment Benefits

- Work Search and Your Eligibility for Unemployment Benefits

- How Do I and Frequently Asked Questions

- Forms & Pamphlets

- Contact Arizona UI

- UI Benefit Fraud

- How To File An Appeal For UI Benefits

- UI Data Dashboard

- Working with a Disability

- Employment Service/Related Law Complaint

- Unemployment - Employer

- Applying for an Unemployment Insurance Tax Account Number

- Report Changes to Your Business

- Reporting Wages and Paying Unemployment Insurance Taxes

- Employment Taxes - Calculating Unemployment Taxes

- Unemployment Insurance Tax Forms

- Unemployment Insurance Tax Frequently Asked Questions

- Request UI Records

- Employer Handbook/ Unemployment Tax

- Employer Handbook/ Unemployment Benefit Claims

- AZ Unemployment Insurance Tax Survey

- Contact the Unemployment Tax Office

- Arizona Shared Work Program

- Senior Community Service Employment Program

- Veterans

- Workforce Innovation and Opportunity Act (WIOA)

- Arizona State Monitor Advocate

- Basic Needs

- How do I?

- Do Business with DES?

- Request a Vendor Meeting

- Frequently Asked Questions

- Learn about HIPAA?

- Request Assistance?

- Request DES Records?

- Submit Website Feedback?

- Work for DES?

- ADA Disability Rights/Reasonable Accommodations

- Volunteer?

- File a Discrimination Complaint

- Report Developmental Disabilities Fraud, Waste and Abuse

- Documents Center

- Media Center

- Office Locator

- Report Fraud

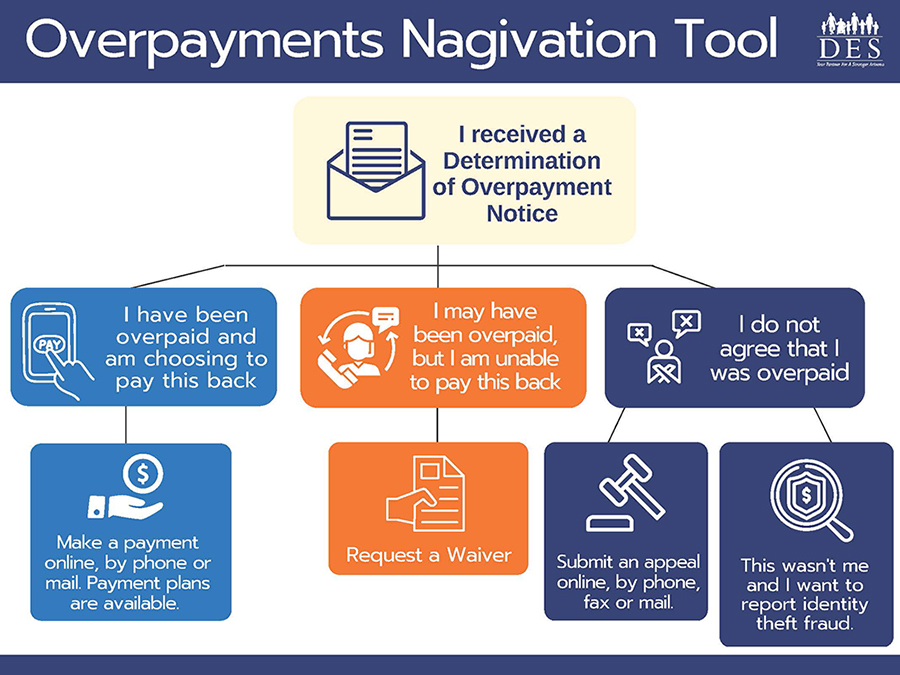

Unemployment and PUA Overpayments

An overpayment is when you collect State or Federal Unemployment Insurance (UI) benefits or Pandemic Unemployment Assistance (PUA) that you are not eligible to receive. Depending on the situation, an overpayment may be determined to be your fault or no fault of your own.

In most cases, overpayments must be paid back even if you have already spent the money and in some cases, a penalty may be applied.

What is an overpayment?

Learn how overpayments are determined, how you’re notified, types of overpayments and more.

How do I appeal an overpayment?

If you disagree with the decision related to your Unemployment claim, you have 15 days from the date of the determination to file an appeal unless you have a qualifying reason for missing the deadline.

How can I request a waiver?

In some circumstances, overpayments may qualify to have some or all of the overpayment amount waived so that you do not owe any money back to us.

How do I pay back my overpayment?

Overpayments can be paid back online, by mail or phone. Payment plans are also available.

Where can I find additional information about overpayments?

To get answers quickly, please review these frequently asked questions before contacting DES.

Where can I get help with my overpayment?

In addition to our comprehensive FAQs, our staff are available to help you understand your overpayment.

Arizona State Resources

Pursuant to Title VI of the Civil Rights Act of 1964, the Americans with Disabilities Act (ADA) and other nondiscrimination laws and authorities, ADES does not discriminate on the basis of race, color, national origin, sex, age, or disability. Persons that require a reasonable modification based on language or disability should submit a request as early as possible to ensure the State has an opportunity to address the modification. The process for requesting a reasonable modification can be found at Equal Opportunity and Reasonable Modification